In an important development that is sure to have significant implications for the Chinese economy, the Communist Party of China has planned to impose property tax in the country. Although nothing is set in stone, for now, murmurs in political circles clearly indicate that something is brewing on this front. It is important to note that the concept of property tax has been debated in China for over two decades, but a concrete policy framework is yet to take shape in this regard.

According to experts and analysts closely watching the Chinese economy and political structure, the decisive mandate that president XI Jinping enjoys is one of the primary reasons behind this potentially reformative step. Jinping is inclined to bridge the gap between the super-rich and common people. This is why the idea of imposing property tax comes into prominence.

Earlier this month, the president talked about the need to regulate extremely high incomes in the country with a slew of measures, including the property tax. Accordingly, the State Council, which is the top executive body, was given the authority to conduct a survey on the property tax for the five years in regions not specified by the government.

Unlike the United States of America, China doesn’t have a policy of blanket property tax. The ownership of real estate in the country also differs as many public sector organizations have distributed flats to their employees. The discussion on property tax began in 2003 in China. Almost two decades later, only two cities, Chongqing and Shanghai, have applied these taxes on a limited scale. In 2020, the contribution of property tax in the local tax revenue of these two cities was 5% or even less, indicating a large scope for improvement.

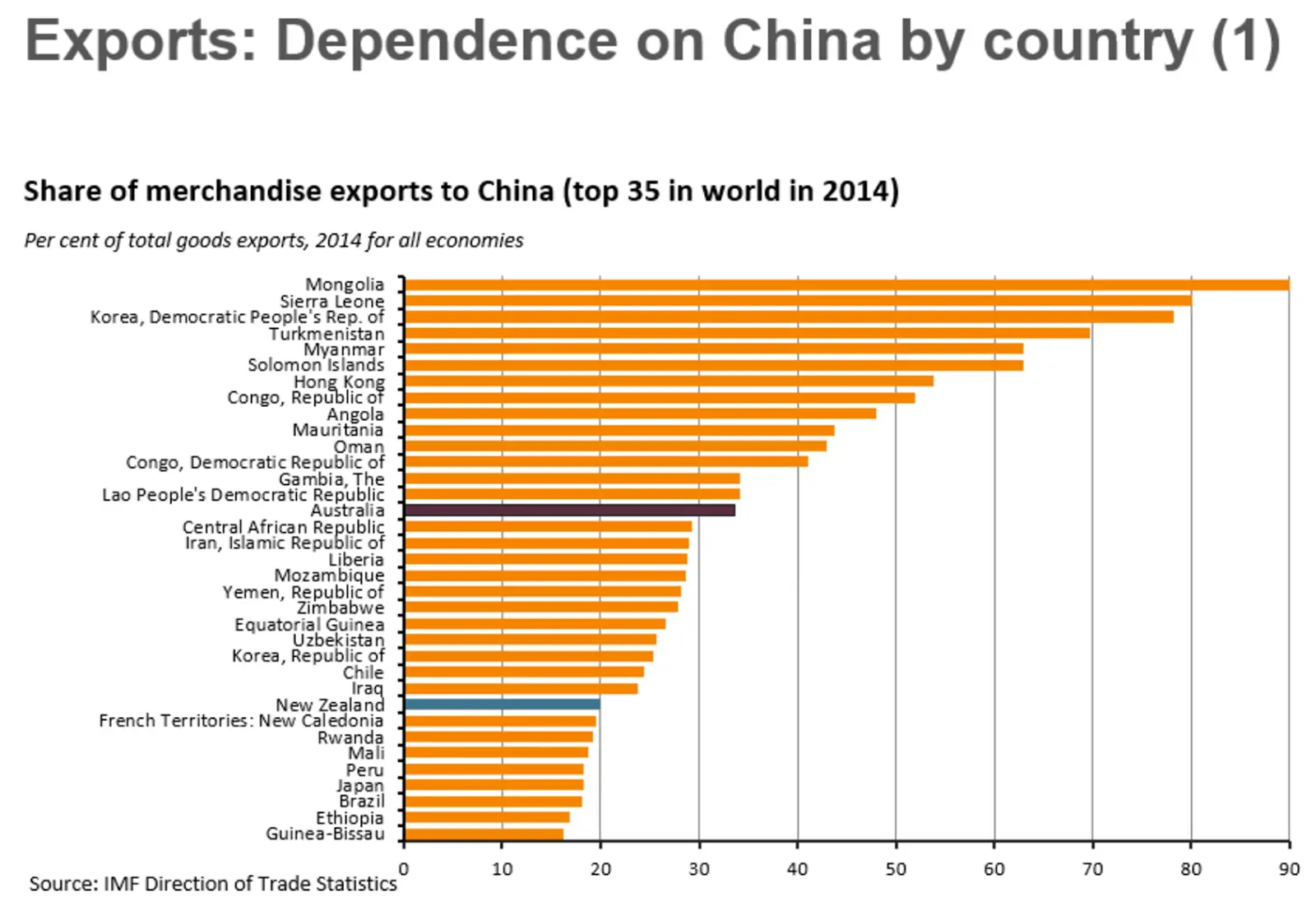

According to the consultancy agency Moody, local and regional governments earn more than 20% of revenue from land sales in their regions. If the property tax policy is implemented successfully, it can bring additional revenue streams, especially for the local governments. In China, construction-related activities and real estate segments account for at least 25% of the GDP. It will be interesting to see whether this new reform of imposing property tax becomes a reality in the future. As China is the second-largest economy in the world, any decision having implications for its economy is bound to impact and shape the global supply chain in a significant manner.

Leave a Reply